Covered California Presents Report to State Leaders on Potential Options to Improve Affordability for Consumers

Tweet This

- Covered California worked with stakeholders and economists to develop options to improve affordability for low- and middle-income consumers and increase the number of people insured in the state.

- The report examines how consumers would benefit with each approach, as well as the costs required and their impact on the individual market.

- Covered California submitted the report, which was required by law, to the Legislature, governor and the new Council on Health Care Delivery Systems.

SACRAMENTO, Calif. — Covered California presented an extensive report, “Options to Improve Affordability in California’s Individual Health Insurance Market,” to state leaders on Friday. The report is the result of months of work with leading economists and stakeholders as California looks to continue to lead the way on implementing the Patient Protection and Affordable Care Act and improving access to quality care for its residents.

“This report provides policy options to decision-makers on ways to enhance the Affordable Care Act, from restoring the individual mandate penalty to increasing the amount of financial help for hundreds of thousands of consumers,” said Covered California Executive Director Peter V. Lee. “We hope this menu of options will provide useful tools as California’s elected leadership seeks to build on the success of the Affordable Care Act.”

The report was prepared pursuant to California’s 2018-19 budget trailer bill (Assembly Bill 1810, Chapter 34, Statues of 2018), which required Covered California to, in consultation with stakeholders and the Legislature, develop and submit to the Legislature by Feb. 1, 2019, options to improve affordability for low- and middle-income consumers. Covered California developed two approaches, with each approach containing different options for implementation.

The approaches include expanding the amount of premium and cost-sharing support for consumers, reinstituting a state-based individual mandate penalty and establishing a state reinsurance program.

The report estimates that, depending on the approach and options taken, more than 750,000 Californians could gain coverage compared to likely enrollment in 2021 without the adoption of these policies. The various approaches and increase in enrollment would also potentially allow consumers to save thousands of dollars in health care costs.

“We applaud California’s leadership for continuing to look for ways to improve our health care system,” Lee said. “Many of these options deserve active consideration by Congress and the administration, as they could be adopted nationally and benefit not only Californians but also millions of Americans across the nation.”

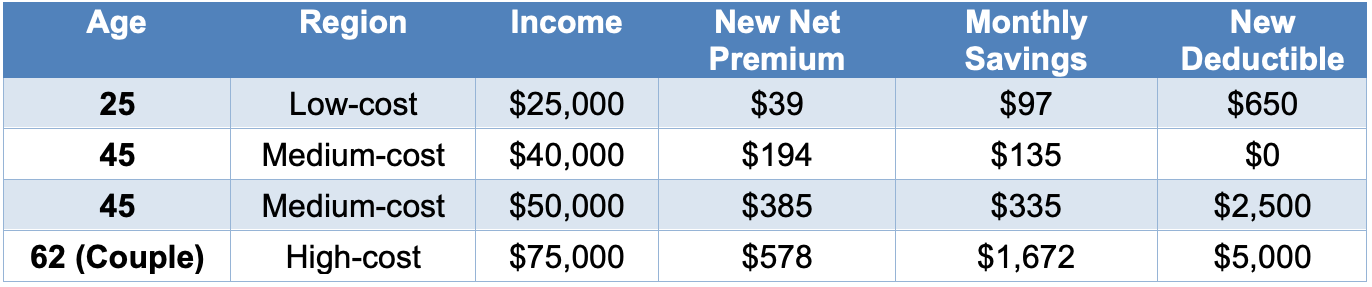

Covered California’s report examined several different scenarios to illustrate how Silver plan consumers could potentially benefit from reduced premiums and lower deductibles. The report highlights the personal experience of individuals and families at different income levels, living in different parts of the state to illustrate how the policies would affect Californians. For example, coupling a statewide individual mandate penalty with expanded and enhanced financial help would have these results for consumers in the following ages and income levels:

Consumer Impact Summary of Approach 1, Option 2

In California, the governor and Legislature have already proposed significant policy changes that would expand financial support for Californians to get and keep coverage and reverse coverage losses that are already beginning due to the federal elimination of the individual mandate penalty.

While not explicitly modeled in the report, Gov. Newsom’s proposed budget recognizes the need to improve health coverage affordability and would increase subsidies to individuals with incomes between 250 and 400 percent of the federal poverty level, and it would expand subsidies for individuals with incomes between 400 and 600 percent federal poverty level. Under the governor’s proposal, the increased subsidies would be funded by revenues generated by establishing a state individual mandate.

“Health care is expensive and so is living in California. We know that affordability remains a major challenge for many,” Lee said. “These options demonstrate that state investments could bring coverage within reach for more people and move us closer to the goal of universal coverage for California.”

About Covered California

Covered California is the state’s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California’s consumers. It is overseen by a five-member board appointed by the governor and the Legislature. For more information about Covered California, please visit www.CoveredCA.com.